Commentary

The markets have been upset dramatically by the expected economic repercussions of the spread of the Covid-19 virus. Last Thursday saw the largest single day drop since Black Monday in 1987.

So far through the end of February and thru these first two weeks of March, our strategies have performed as expected which means the Long Short strategies have materially out-performed the markets and the long only strategies are performing similar to the markets they model themselves after.

The long short strategies all have market index hedges in the ETFs that best represent the majority of the stock portfolio exposure. Those hedges have been very effective in off-setting the losses so far. We have already harvested the hedges in these portfolios once and re-invested the avoided losses back in the markets here in March. The new hedges we rolled down to are ALREADY in the money. We will look to harvest those losses and roll those down also.

This significant market displacement has created significant sell-offs across all market caps but small caps have been hit the hardest. Our portfolio is typically around 40% large cap and 60% mid and small cap. Our long portfolios within the long short and within the long only strategies have held up well when compared to the markets YTD and in February and March. Our portfolio typically has higher beta than the broader markets but despite that character, our portfolio returns have been in line with the performance of a mix of the S&P 500 and the Russell 2000.

So far in March, the hedges in our long short portfolios have offset more than half of the losses in the underlying stock portfolios. Avoided losses, once harvested thru the hedges, is a great way to set up the portfolio for the eventual market recovery.

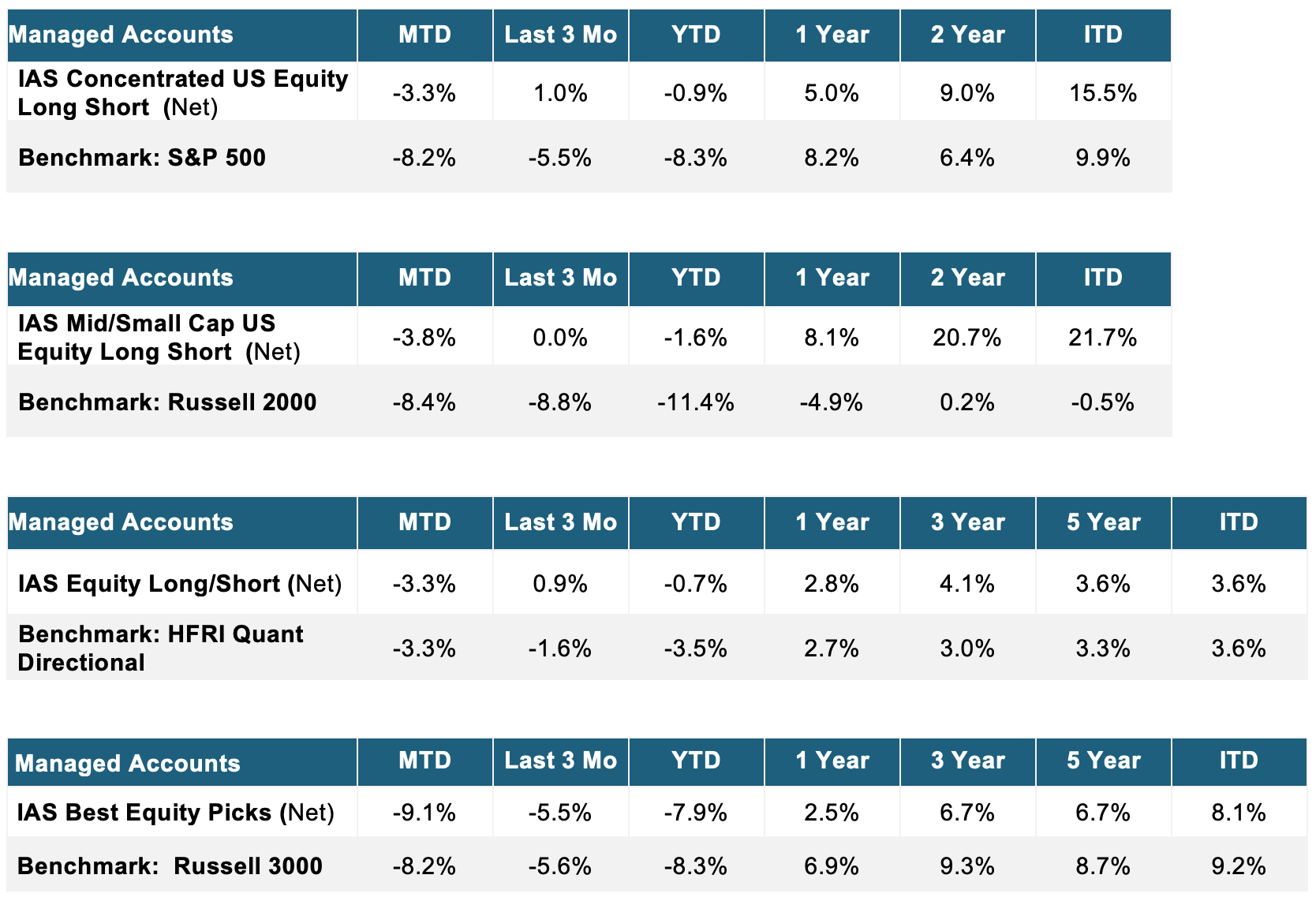

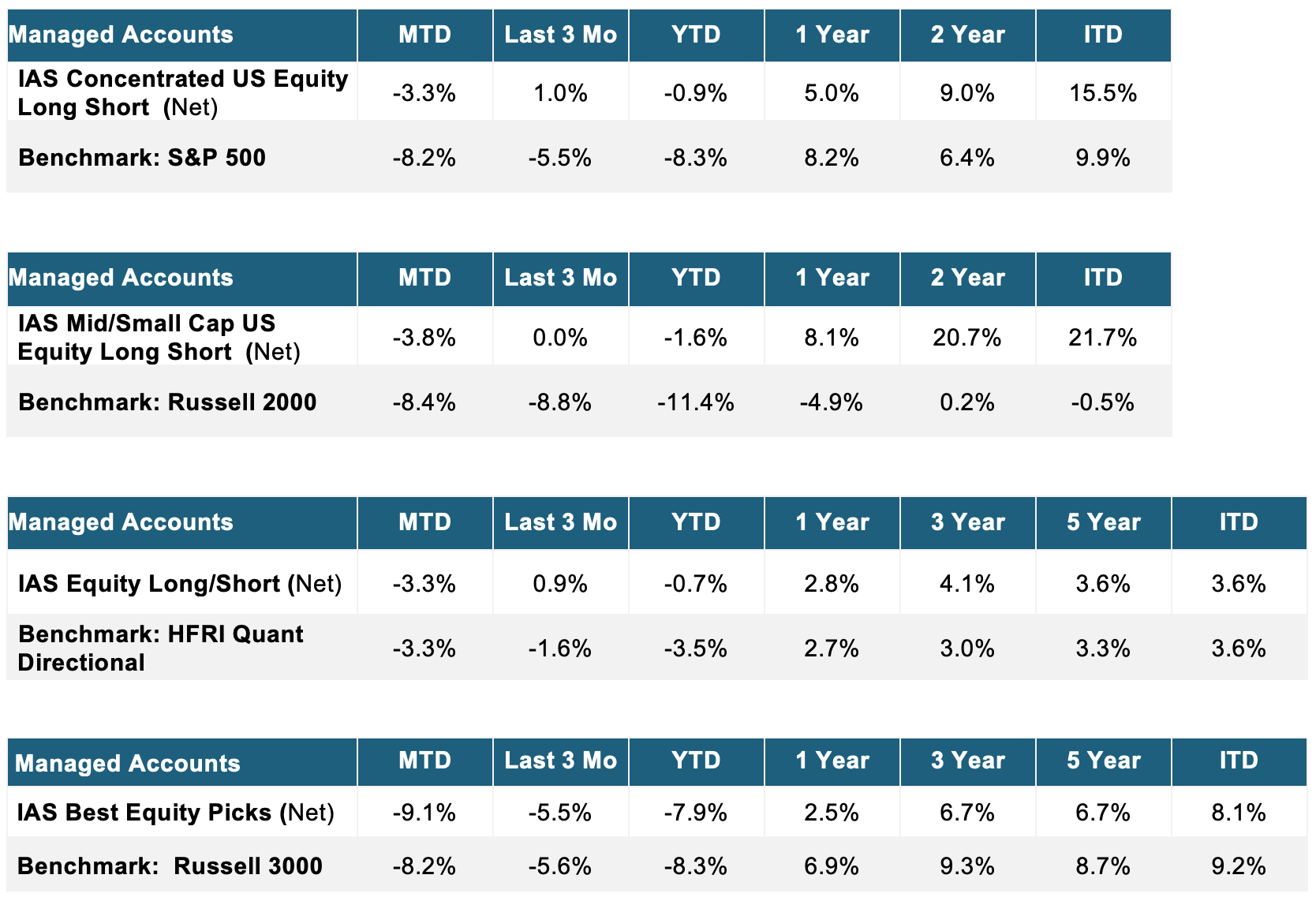

The results are summarized below. Check out the returns on our website for all of these strategies at www.alphadnaim.com

As usual, if you’d like to find out more about our strategies, let’s schedule a call. Email me at wayne.ferbert@alphadnaim.com or call me at 443-288-6444

PERFORMANCE as of 2/29/2020

ITD & 3 Year and 5 Year Returns are annualized. For the IAS Concentrated US Equity Long Short, the inception is March 1, 2017. For the IAS Mid/Small Cap US Equity Long Short, the inception is January 1, 2018.

A quick refresher on what the IAS strategies are: IAS stands for Internet Advantage Strategy. We use real-time big data generated by consumers online to measure the digital interaction of over 2,000 publicly traded companies. The data is analyzed and compared to historical data to find trends that imply a company is having stand-out success (or lack thereof) in its industry. Our platform identifies the best possible investments every month based on the changing digital footprints that we observe. We deploy in Equity Long/Short and Long-only (called the Best Equity Picks) formats.

You can find a summary of our returns below. Please reach out to talk to us about these exciting cutting edge strategies at (443)-288-6444. Or email us at wayne.ferbert@alphadnaim.com

Disclosures:

Note: Returns are expressed in US Dollars net of fees.

Alpha DNA Investment Management is a registered investment adviser and investment manager that specializes in quant equity strategies. Alpha DNA is a separate accounts manager and all returns expressed herein are solely from the separate accounts business within Alpha DNA.

INTERNET ADVANTAGE STRATEGY: EQUITY BEST PICKS Composite includes all institutional and retail portfolios that invest in a highly diversified portfolio with up to 60 holdings. The portfolio is made up of Large, Mid, and Small Cap U.S. equities designed to be long only. The strategy aims to outperform the market by identifying the stocks most likely to out-perform based on changing demand. The Internet Advantage Strategies is a series of strategies based on an innovative new research approach: ZEGA tracks the digital Internet footprint of publicly traded companies to find hidden demand trends in the market place. This composite includes all portfolios that were at least 70% dedicated to this strategy. The benchmark is the Russell 3000 Index. The Russell 3000 Index is a collection of 3,000 of the publicly traded US Equity companies that span large cap, mid cap, and small cap categories.

INTERNET ADVANTAGE STRATEGY: EQUITY LONG/SHORT Composite includes all institutional and retail portfolios that invest in a diversified portfolio of over 50 total U.S. equity positions – either long and/or short. The strategy aims to reduce systematic market risk by identifying the stocks most likely to out-perform other stocks based on changing demand. Risk is further mitigated by implementation in market neutral posture when the research indicates potential for a downward market. The portfolio is designed to find picks that will out-perform the counter-parts. The Internet Advantage Strategies is a series of strategies based on an innovative new research approach; ALPHA tracks the digital Internet footprint of publicly traded companies to find hidden demand trends in the market place. This composite includes all portfolios that were at least 70% dedicated to this strategy. The benchmark is the HFRI Quantitative Directional Equity Hedge Fund Index. The HFRI Quantitative Directional Equity Hedge Fund Index is a subset of the HFRI Equity Hedge Fund Index that measures the aggregate performance of equity hedge funds that employ quantitative strategies that can use long and short equity positions and the portfolio can be positioned net long or net short. HFRI benchmark will always include an estimate from HFRI for the most recent month. The returns are typically finalized by HFRI within one month after the end of the reported month – but can sometimes be revised up to 90 days later by HFRI.

Alpha DNA claims compliance with the Global Investment Performance Standards (GIPS). To receive a full list of composite descriptions of Alpha DNA and/or a presentation that complies with the GIPS standards, contact Wayne Ferbert at (443)-288-6444 or wayne.ferbert@alphadnaim.com

All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results and there can be no assurance, and clients should not assume, that future performance of any of the model portfolios will be comparable to past performance.

These results should not be viewed as indicative of the advisor’s skill. The prior performance figures indicated herein represent portfolio performance for only a short time period, and may not be indicative of the returns or volatility each portfolio will generate over a long time period. The performance presented should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the performance information. The actual results for the comparable periods would also have varied from the presented results based upon the timing of contributions and withdrawals from individual client accounts. The performance figures contained herein should be viewed in the context of the various risk/return profiles and asset allocation methodologies utilized by the asset allocation strategists in developing their model portfolios, and should be accompanied or preceded by the model.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. In finance, standard deviation is applied to the annual rate of return of an investment to measure the investment's volatility.