Analysis: No seasonality in Alpha DNA's returns - just the way we like it

November 23, 2021

On occasion, we have advisors ask us the following: Given our focus on earnings season, is there any seasonality within our returns? More to the point, should I time my client’s entry around earnings?

Our answer: No. We don't see any meaningful advantage to timing entries.

While our answer is pretty much what you’d expect from an asset manager, we believe the question comes from an interesting place. Specifically, our clients tend to ask this question after we post a very strong price response during earning season – like the one we delivered in the first two weeks of November 2021.

In this blog post we are going to spend some time exploring why the question is particularly pertinent to our strategies and why we believe our answer is theoretically and practically the correct one.

At Alpha DNA, a key driver of our equity outperformance is our ability to identify hidden demand that will soon become public information. One of the common methods for uncovering the demand is earnings season! As many of our advisors are aware, earnings events are not spread evenly throughout the year. The first/third months of the quarter tends to have fewer earnings events while the second month (February, May, August, November) contains the majority of the earnings events. This begs the question as to whether it would make sense to just invest in the Alpha DNA strategies ahead of the second months of the quarter as the best entry point.

Again, an interesting thought, but it doesn’t match our investor’s experience.

For starters, Wall street analysts don’t make just one prediction per quarter. Like us, they are updating their estimates whenever they believe there is significant reasons to change them. This means that while the reported earnings are the ultimate arbiter of earnings surprise, we frequently see stock prices adjust as analysts make their changes throughout the period. In other words, the earnings event itself is not the only catalyst for stock price movement.

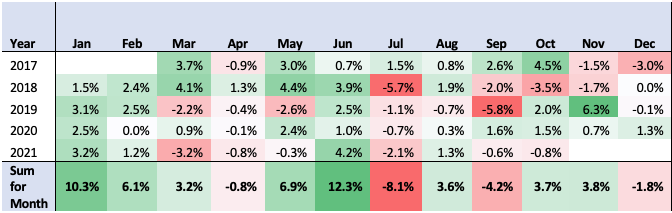

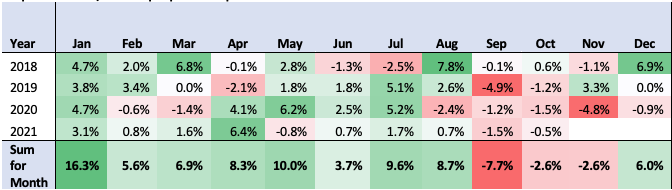

Of course, you don’t have to take our word for it. We believe that the numbers support us as well. We cannot see a predictable pattern in our returns based on the seasonality of earnings. We have isolated the equity portion only of the Large Cap Hedged Equity and the Mid-Small Cap Hedged Equity.

In the tables, we see that sometimes the best price response comes during earnings season (second month of the quarter). And other times, the best price response comes in the first month of the quarter which is the build-up to earnings. And there are times when the best price response comes in the portfolio re-positioning that inevitably always follows an earnings season (the last month of the quarter).

Table 1: Relative Performance of the Equity Only portion of the Large Cap Hedged Equity SMA to the S&P 500 (Gross Returns)

Table 2: Relative Performance of the Equity Only portion of the Mid-Small Cap Hedged Equity SMA to the Russell 2000 (Gross Returns)

As you can surmise from this data yourself, timing your entry to our strategies would just be a guessing game. Instead, you are better off getting in when the allocation decision is made. Overall, we are very pleased with our equity performance, and we are continually striving to maintain and improve our performance.

Disclosures:

Note: Returns in the supplemental reporting above is for a portion of the portfolio only - and is presented GROSS of fees.

Alpha DNA Investment Management is a registered investment adviser and investment manager that specializes in quant equity strategies. Alpha DNA is a separate accounts manager and all returns expressed herein are solely from the separate accounts business within Alpha DNA.

Alpha DNA claims compliance with the Global Investment Performance Standards (GIPS). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To receive a full list of composite descriptions of Alpha DNA and/or a presentation that complies with the GIPS standards, contact Wayne Ferbert at (443)-288-6444 or wayne.ferbert@alphadnaim.com

All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results and there can be no assurance, and clients should not assume, that future performance of any of the model portfolios will be comparable to past performance.

These results should not be viewed as indicative of the advisor’s skill. The prior performance figures indicated herein represent portfolio performance for only a short time period, and may not be indicative of the returns or volatility each portfolio will generate over a long time period. The performance presented should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the performance information. The actual results for the comparable periods would also have varied from the presented results based upon the timing of contributions and withdrawals from individual client accounts. The performance figures contained herein should be viewed in the context of the various risk/return profiles and asset allocation methodologies utilized by the asset allocation strategists in developing their model portfolios, and should be accompanied or preceded by the model.