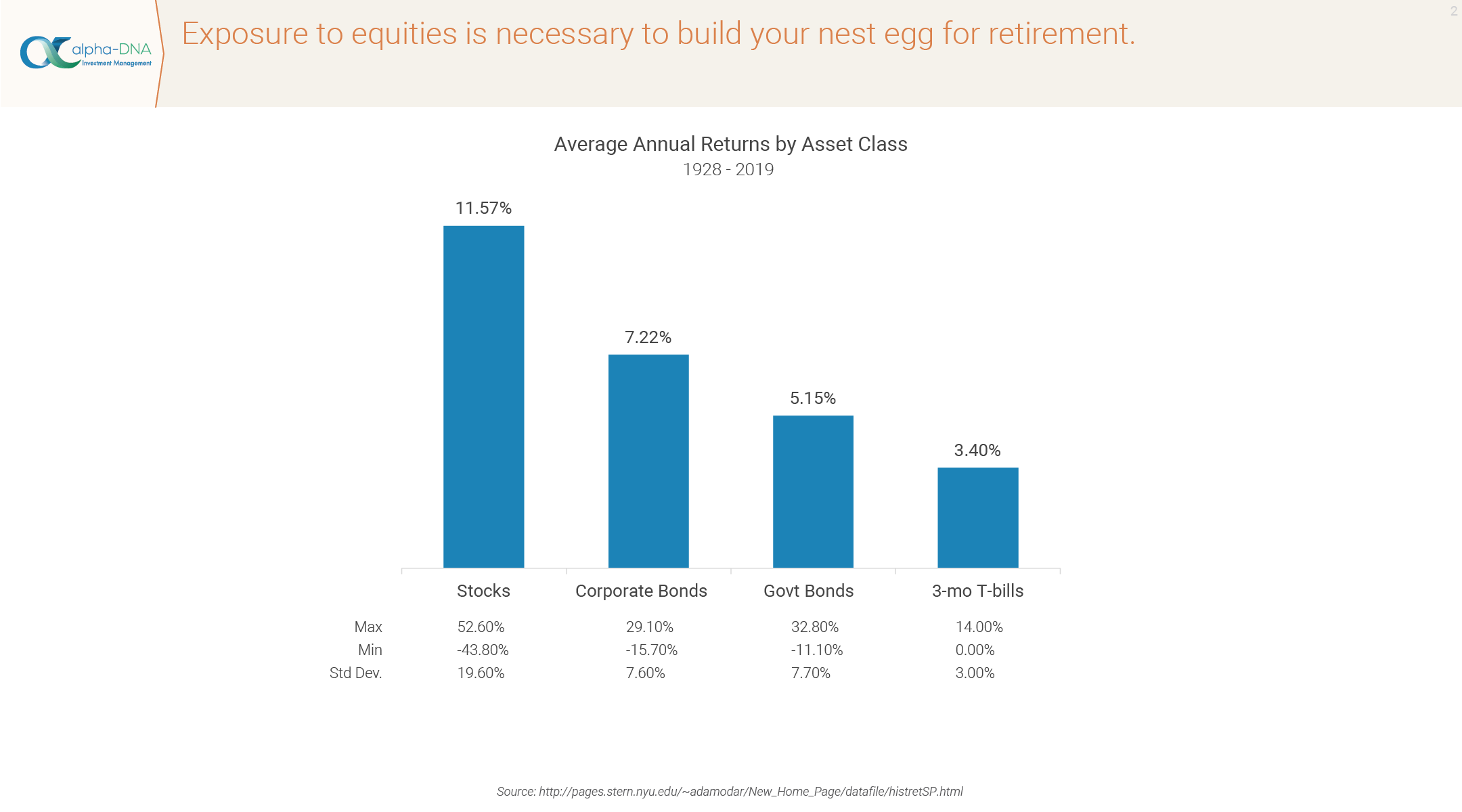

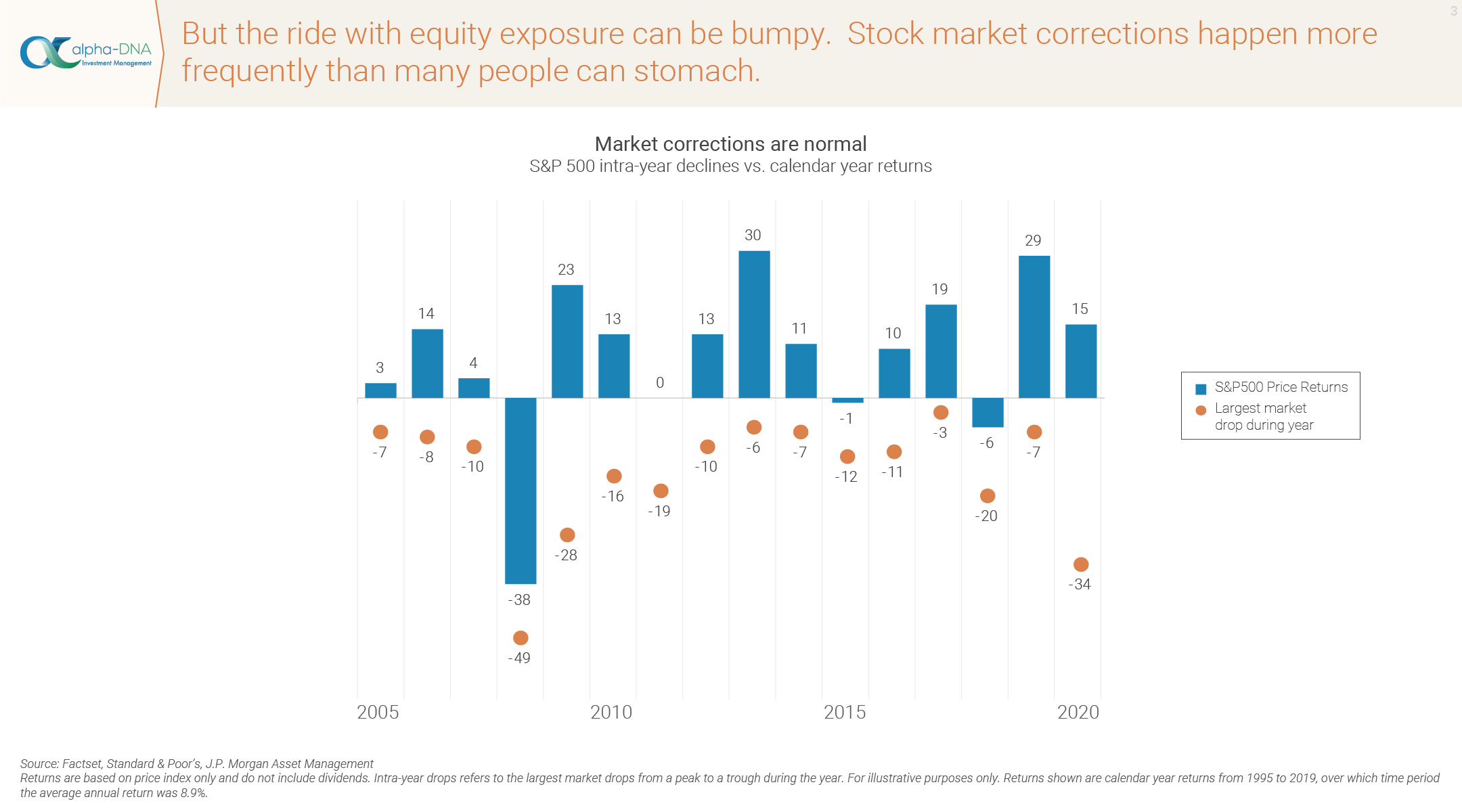

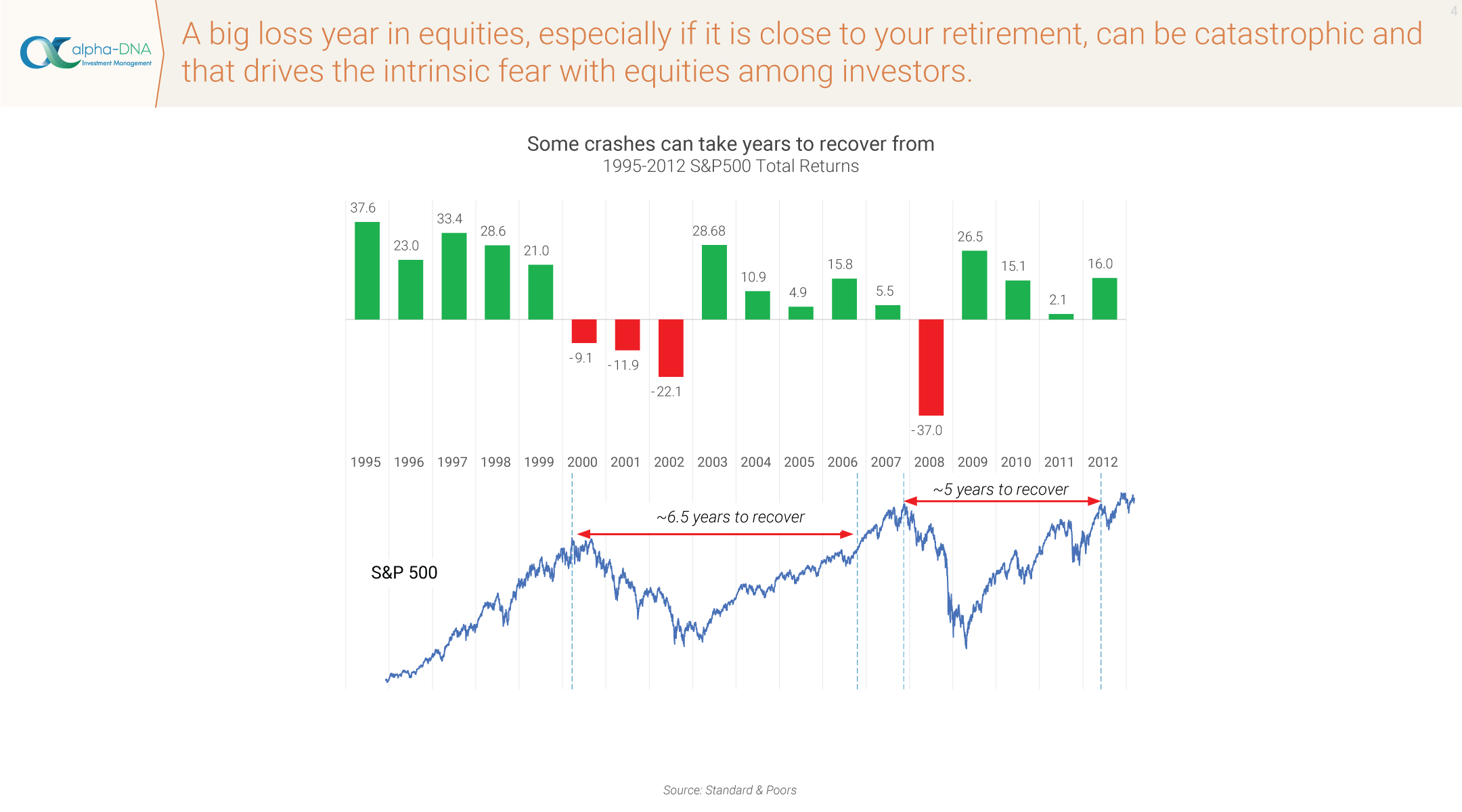

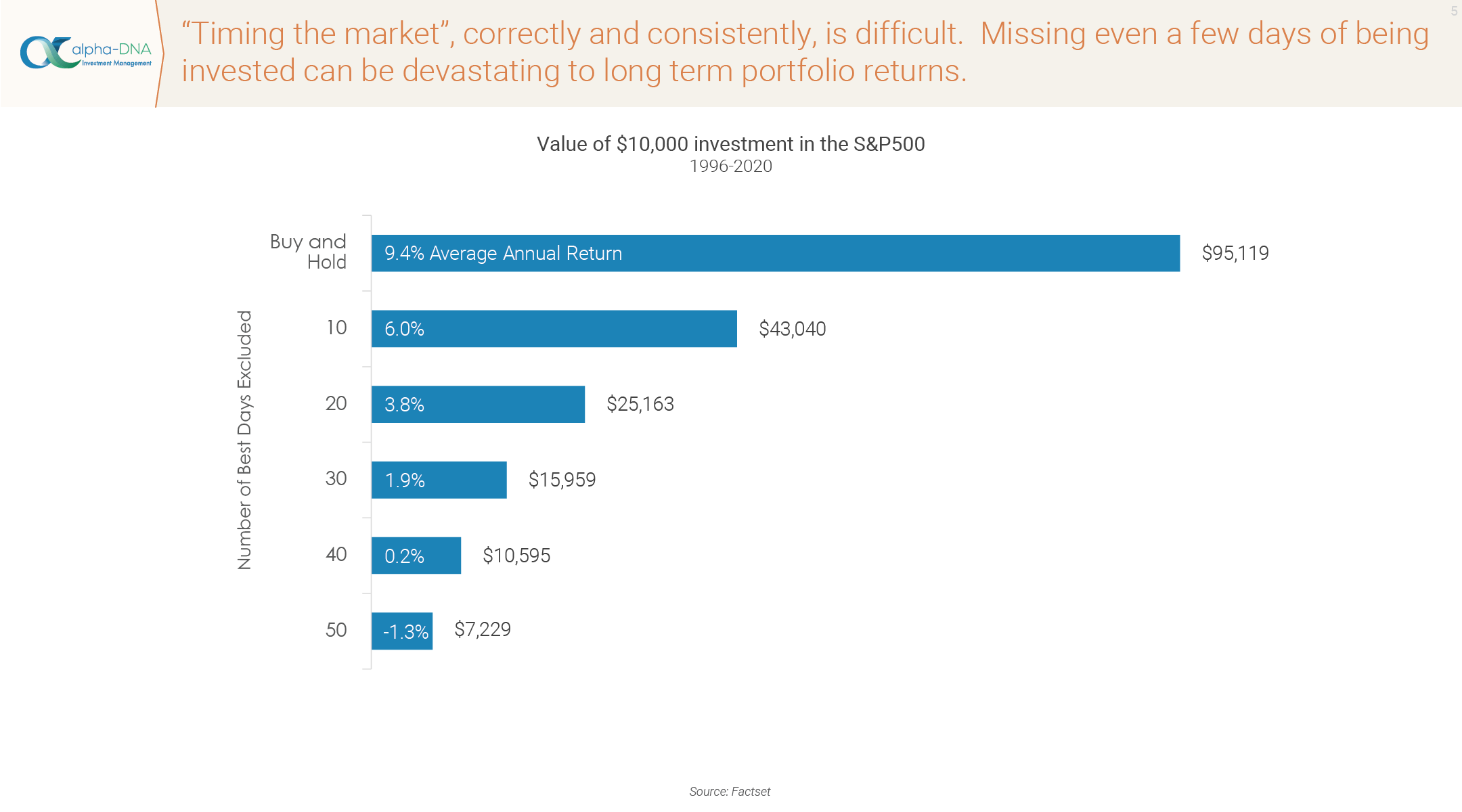

Equity ownership drives long-term returns – exposure to equities is necessary to build your nest egg for retirement. But the ride with equity exposure can be bumpy. Stock market corrections are normal, and they happen more frequently than most people can stomach. A big loss year in equities, especially if it is close to your retirement, can be catastrophic and that drives the intrinsic fear with equities among investors. It is tempting for investors to try to sequence their entry (and exit) in the stock market. But “timing the market” correctly, and on a consistent basis, is difficult. An investor can lose out on capital appreciation by staying in the sidelines.

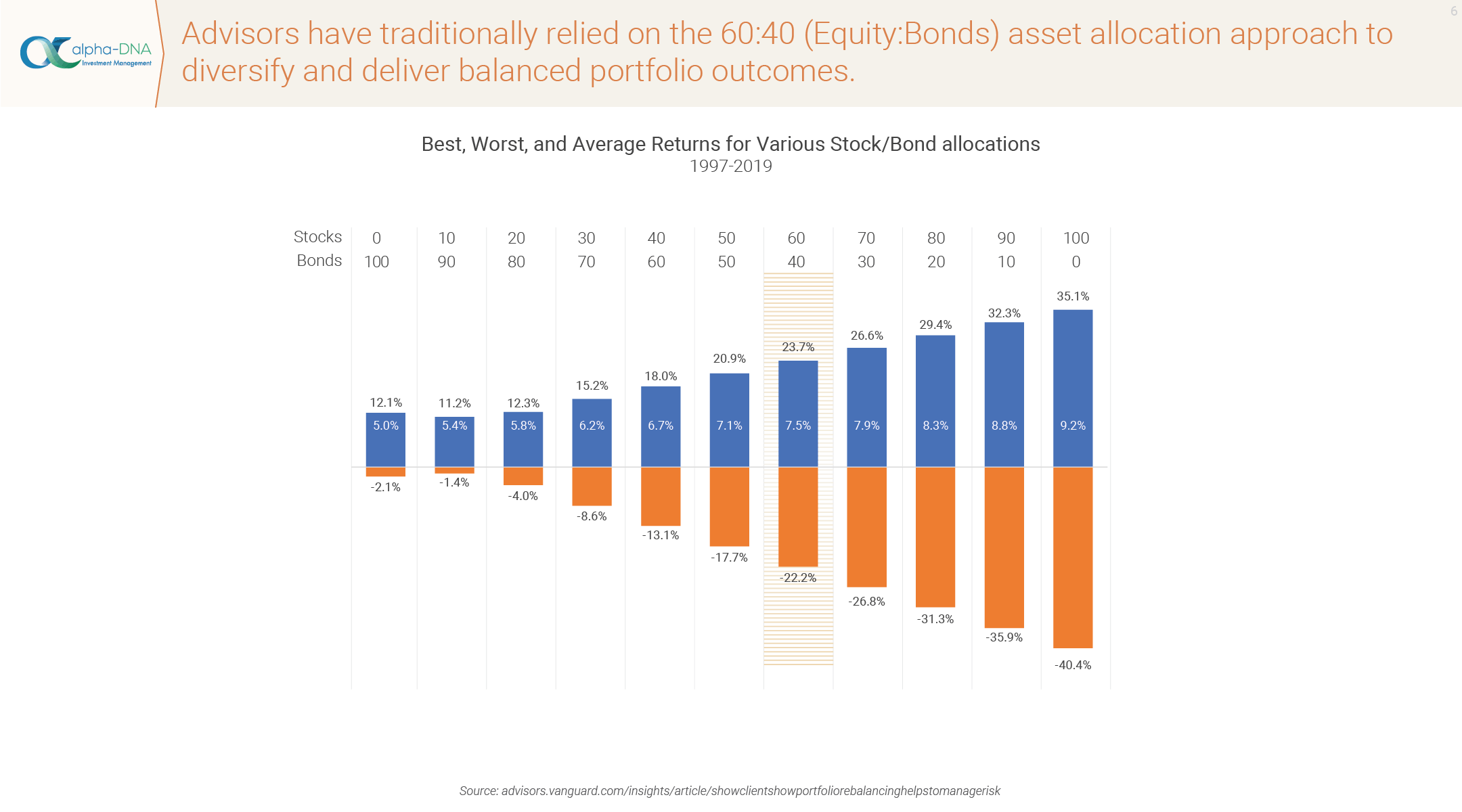

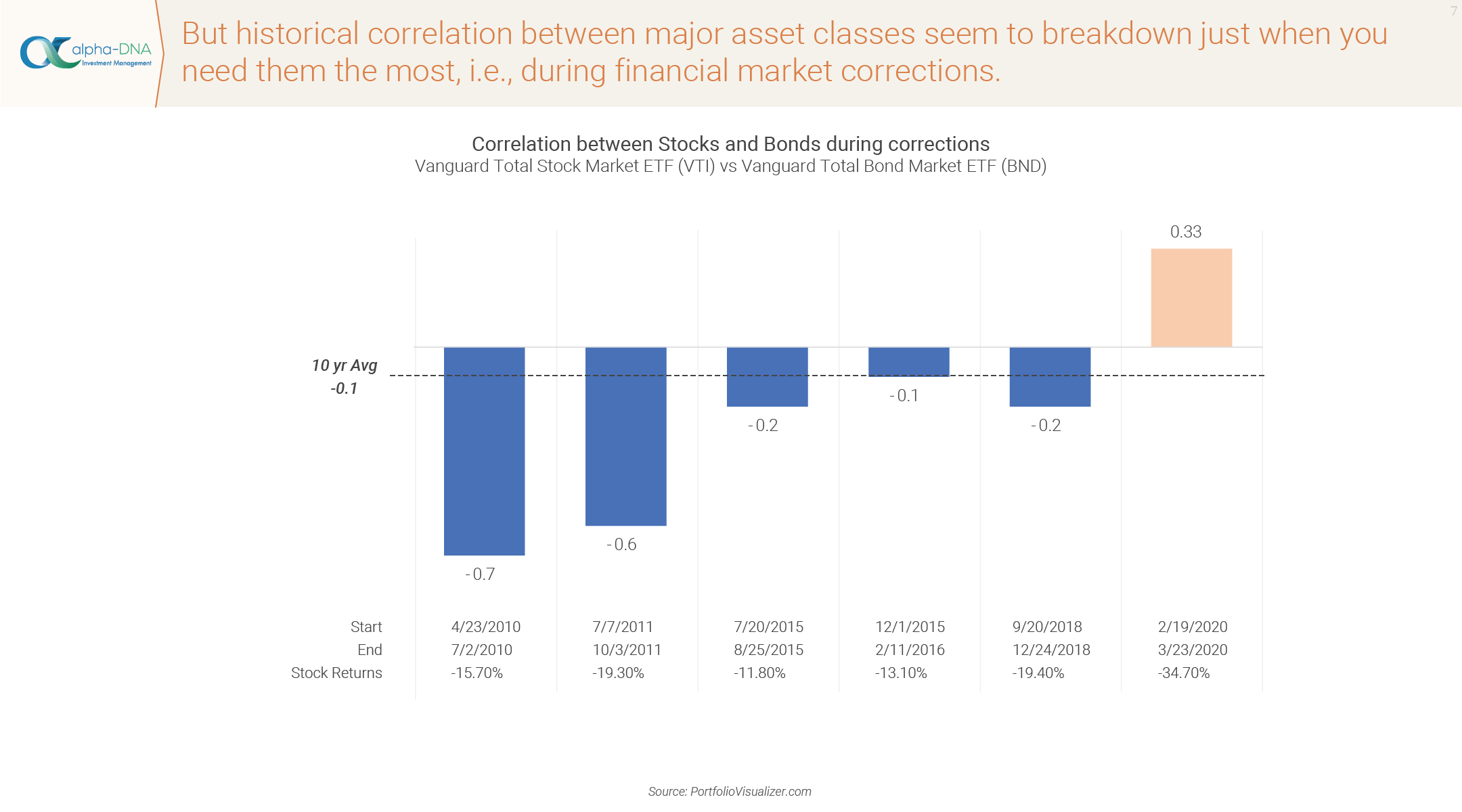

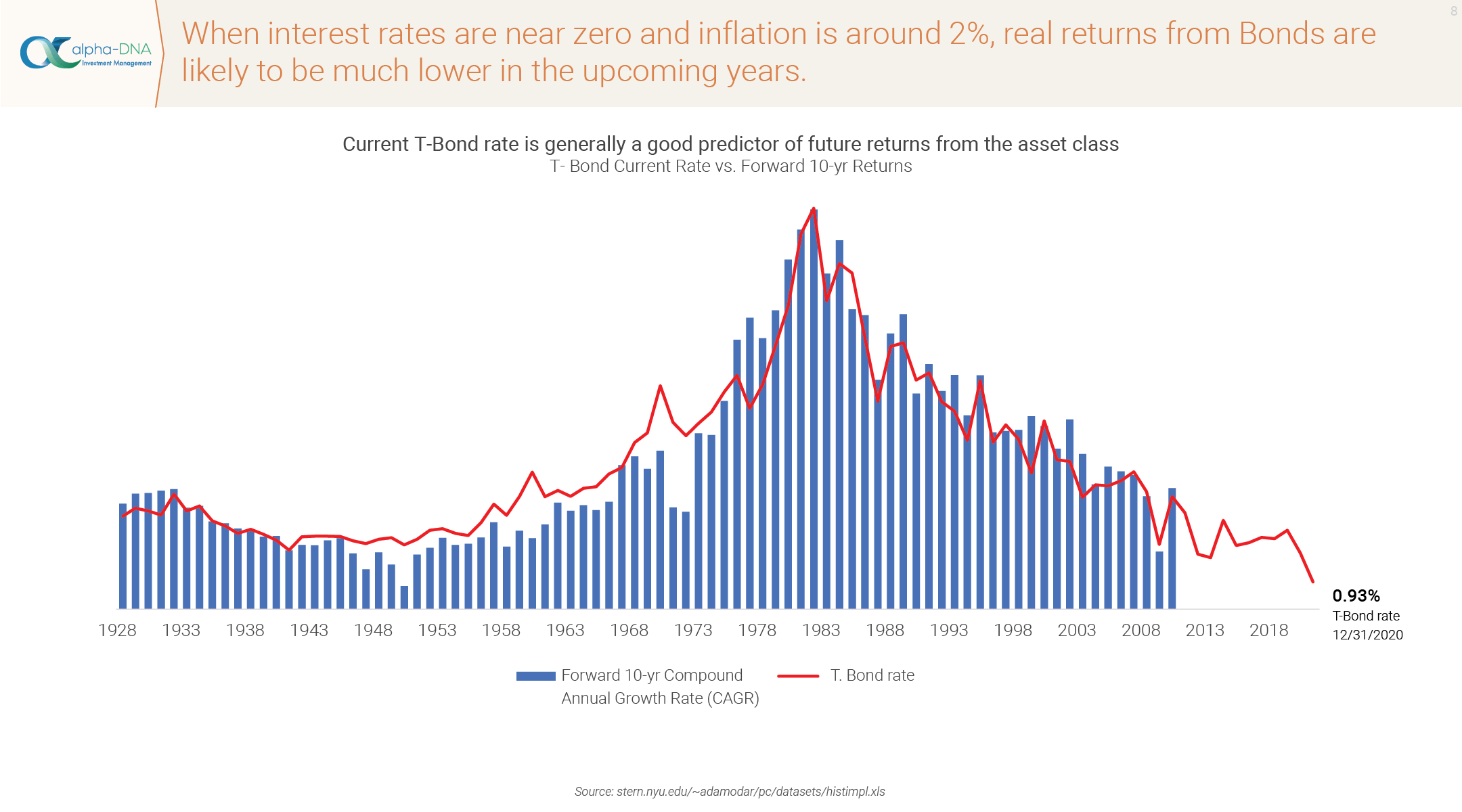

Advisors have traditionally relied on the 60:40 (Equity:Bonds) asset allocation approach to diversify and deliver balanced portfolio outcomes, largely driven by historical correlation between major asset classes. But in recent times, with a hyper-active Federal Reserve and increasingly more complex Quantitative Easing (QE) paradigms, historical correlations between asset classes seem to breakdown just when you need them the most, i.e., during financial market corrections. Furthermore, with interest rates near zero and inflation around 2%, real returns from Bonds overall are likely to be underwhelming in the near future.

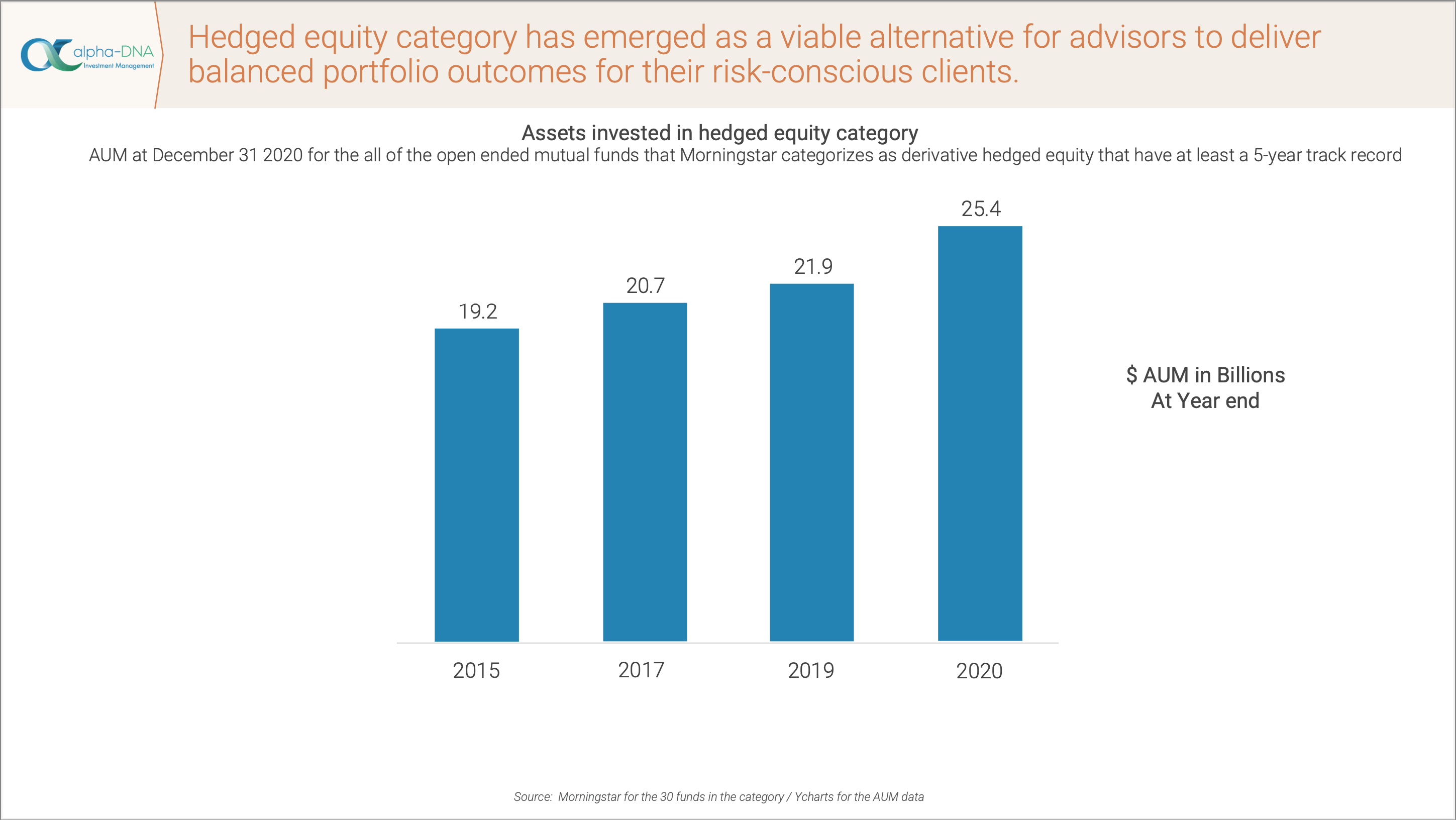

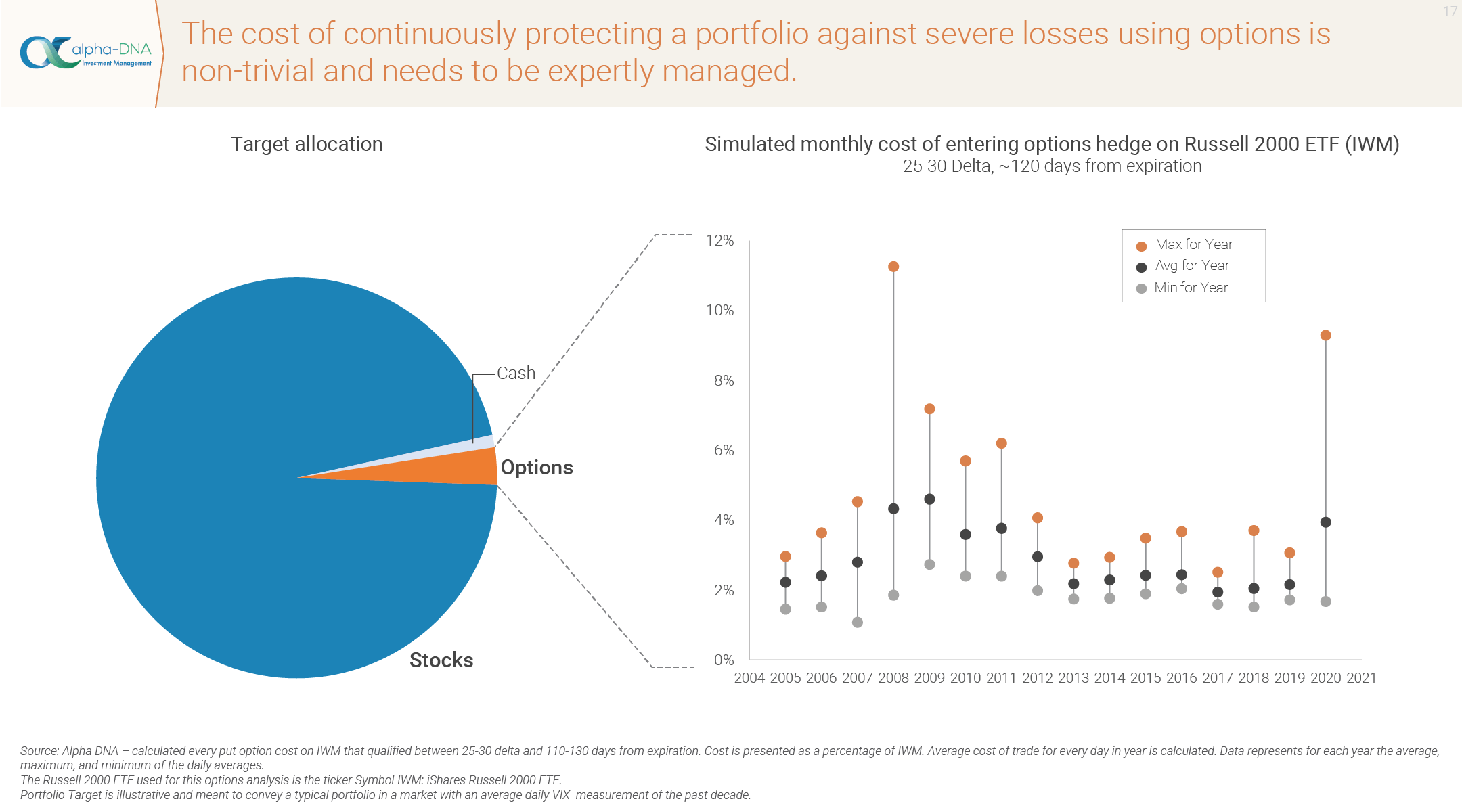

The Hedged Equity category has emerged as a viable alternative for Advisors to deliver balanced portfolio outcomes for their risk-conscious clients. Hedged Equity strategies use a combination of bullish and bearish positions to construct a diversified portfolio with an intentional exposure to market risk. The bullish position (using a portfolio of individual stocks or index Exchange Traded Funds (ETFs)) is intended to keep pace with broad market index returns over the long run and the bearish position (mostly in options on index ETFs) is intended to reduce volatility and reduce the impact of large drawdowns during market corrections. With a risk profile similar to a 60:40 balanced fund, Hedged Equity strategies allow you to add equity allocation without adding full on equity risk.

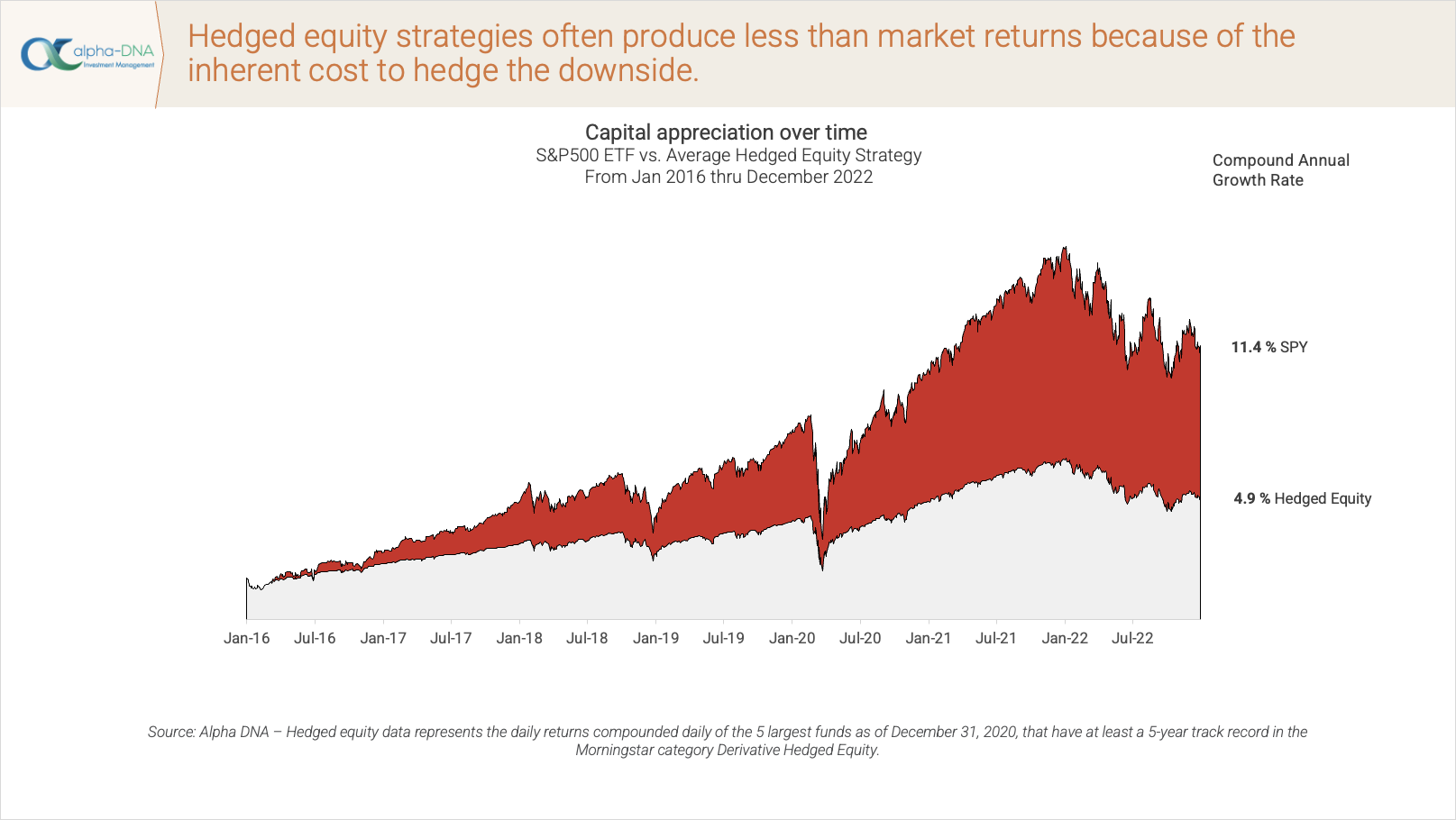

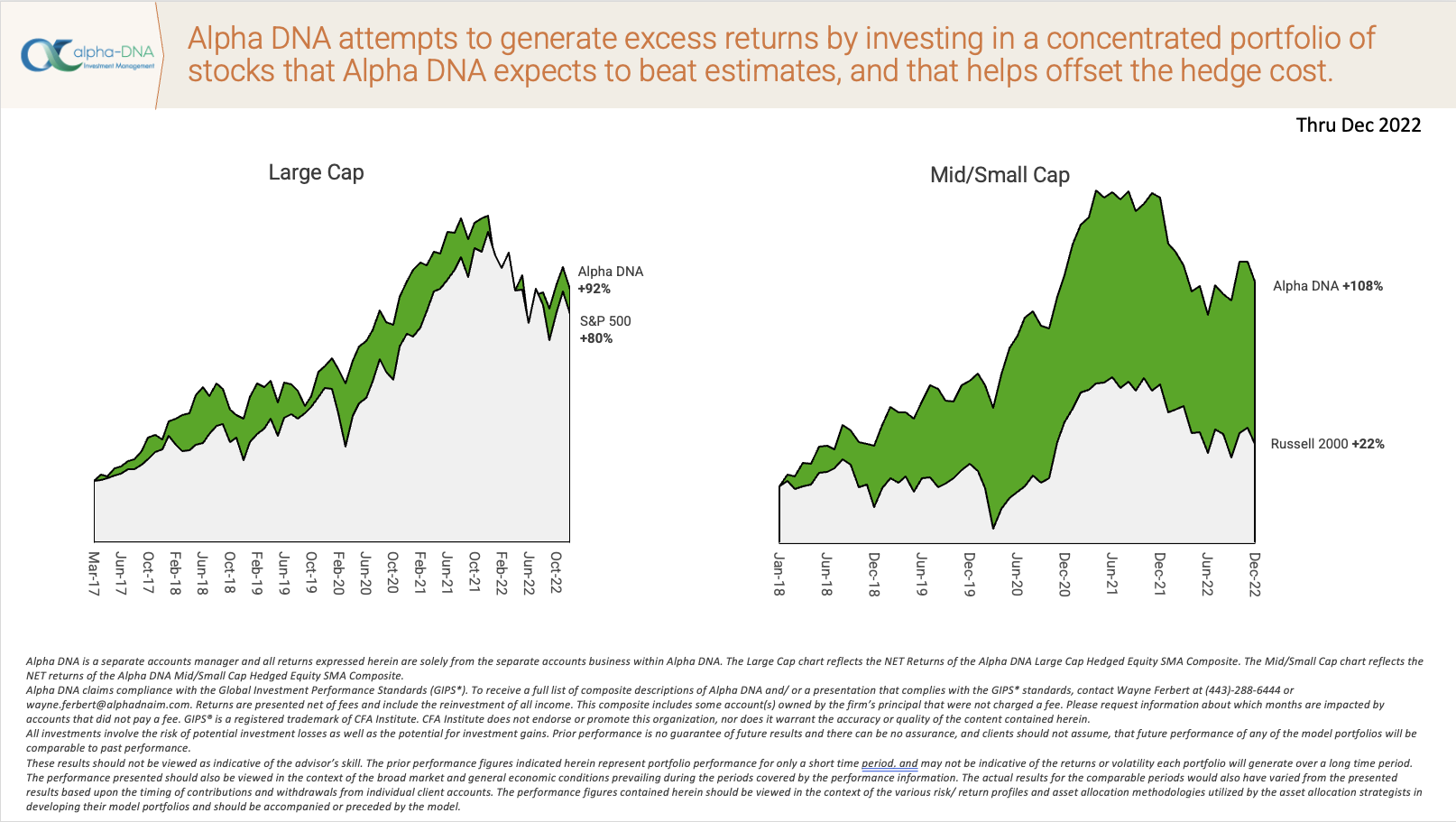

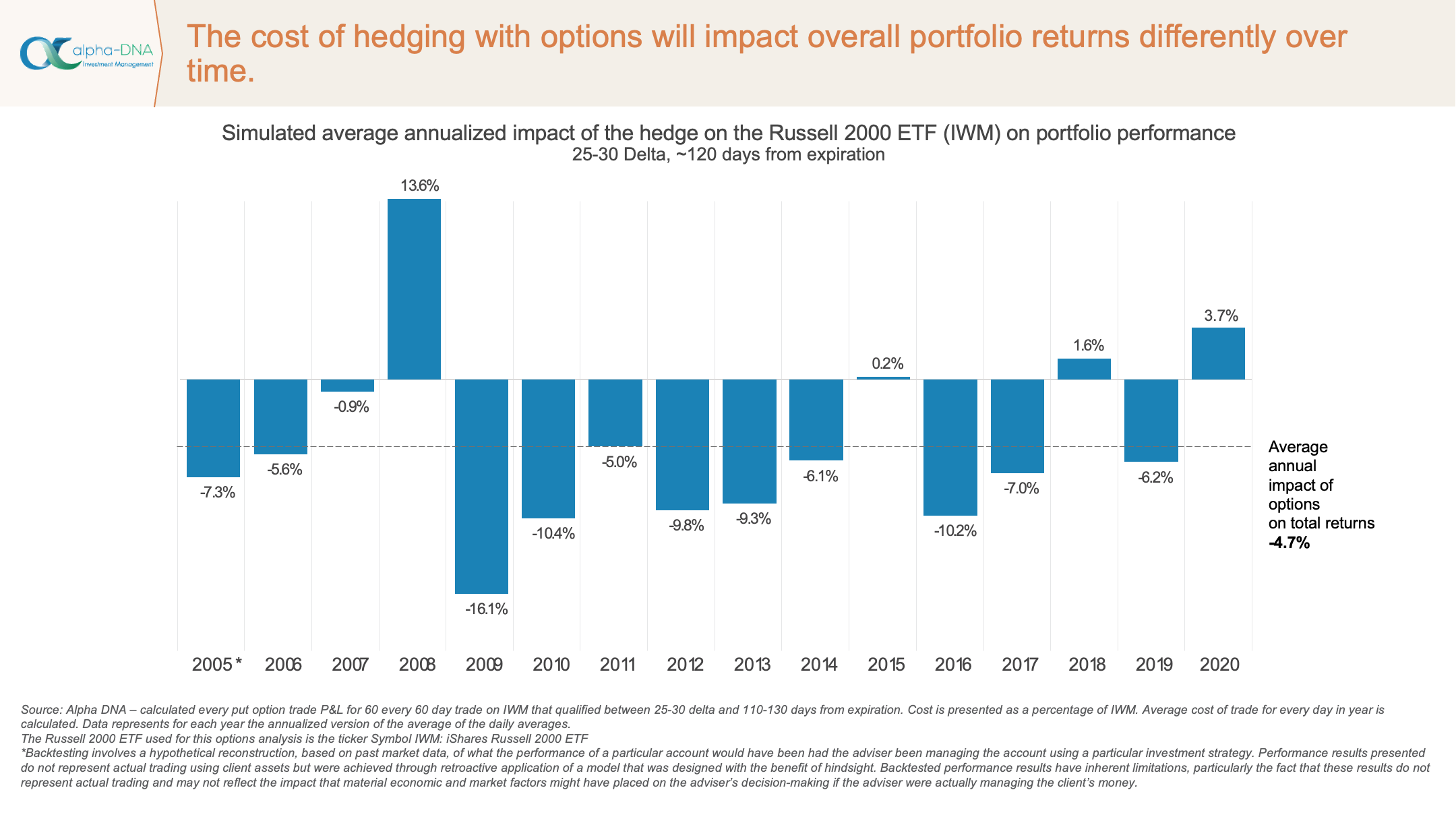

Most Hedged Equity strategy returns tend to trail overall equity market returns. This is because the cost of the hedge eats away some of the returns from the bullish portfolio, which is typically designed to simply track the market. This reduces the capital appreciation for your clients over time, albeit at lower volatility. It doesn’t have to be that way though, just look at Alpha DNA Hedged Equity performance since inception.

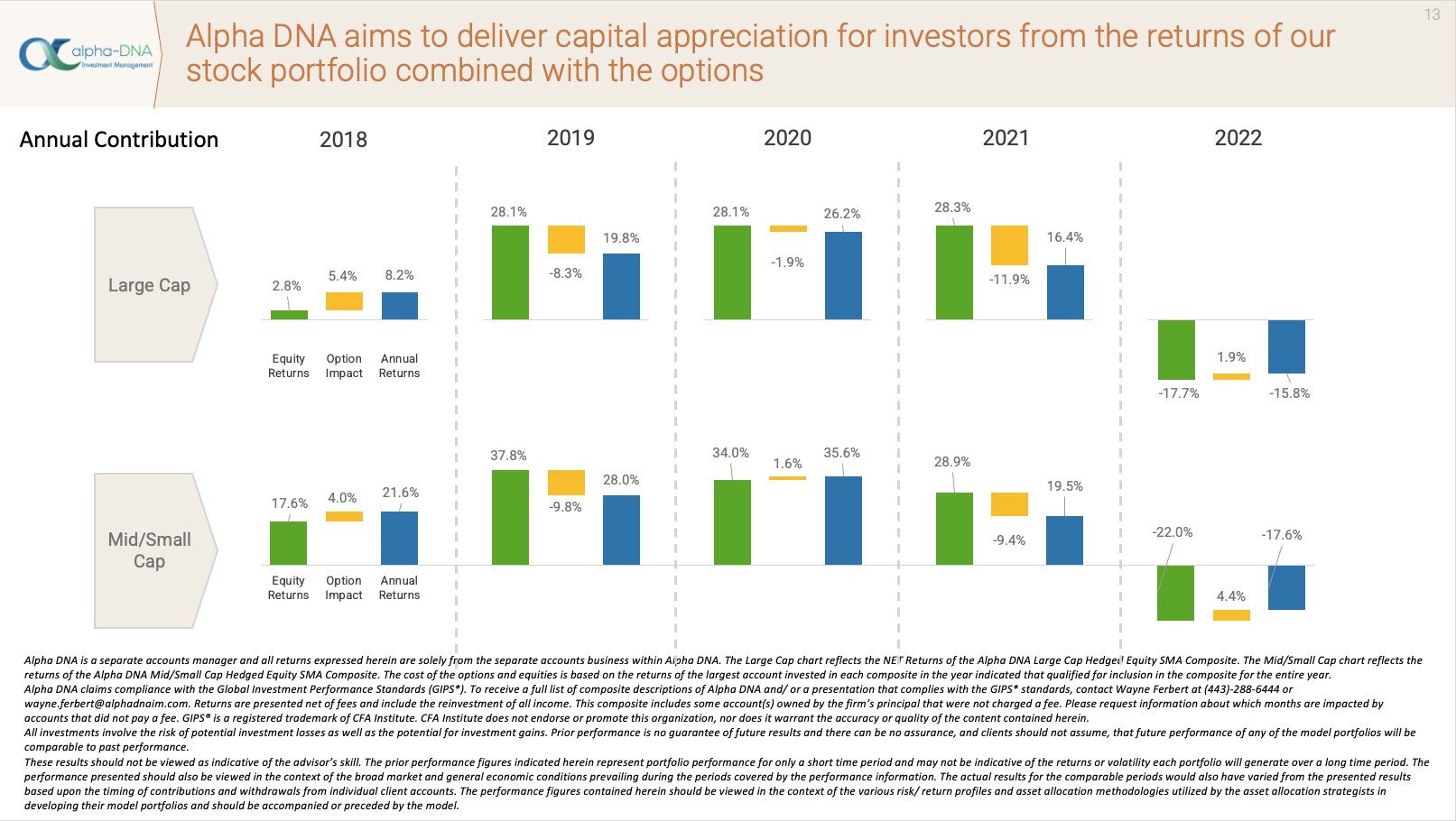

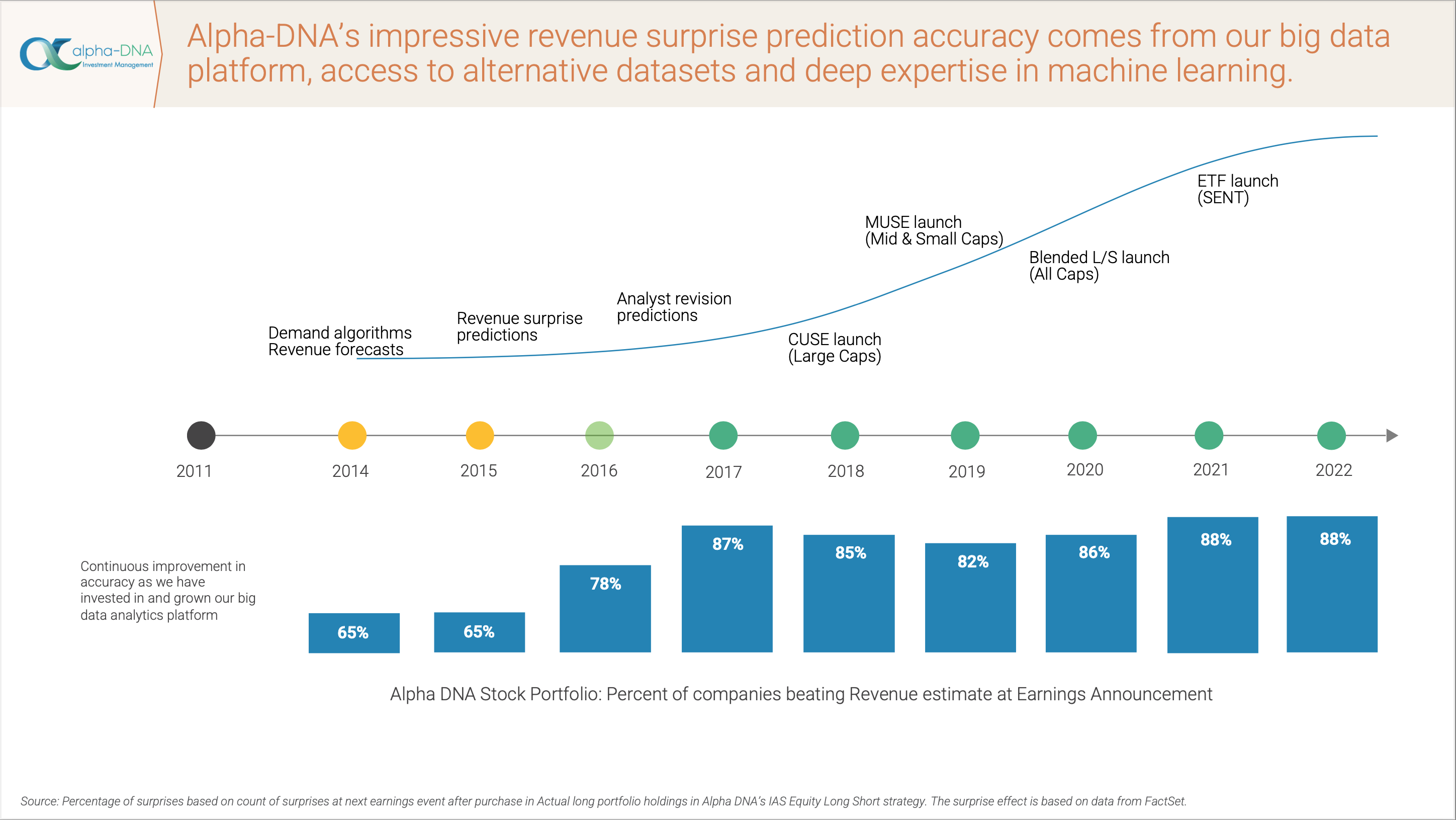

We have generated excess returns from a concentrated portfolio of stocks, systematically selected for our assessment of their probability of beating expectations, and that excess return has helped to offset the cost of the hedge.

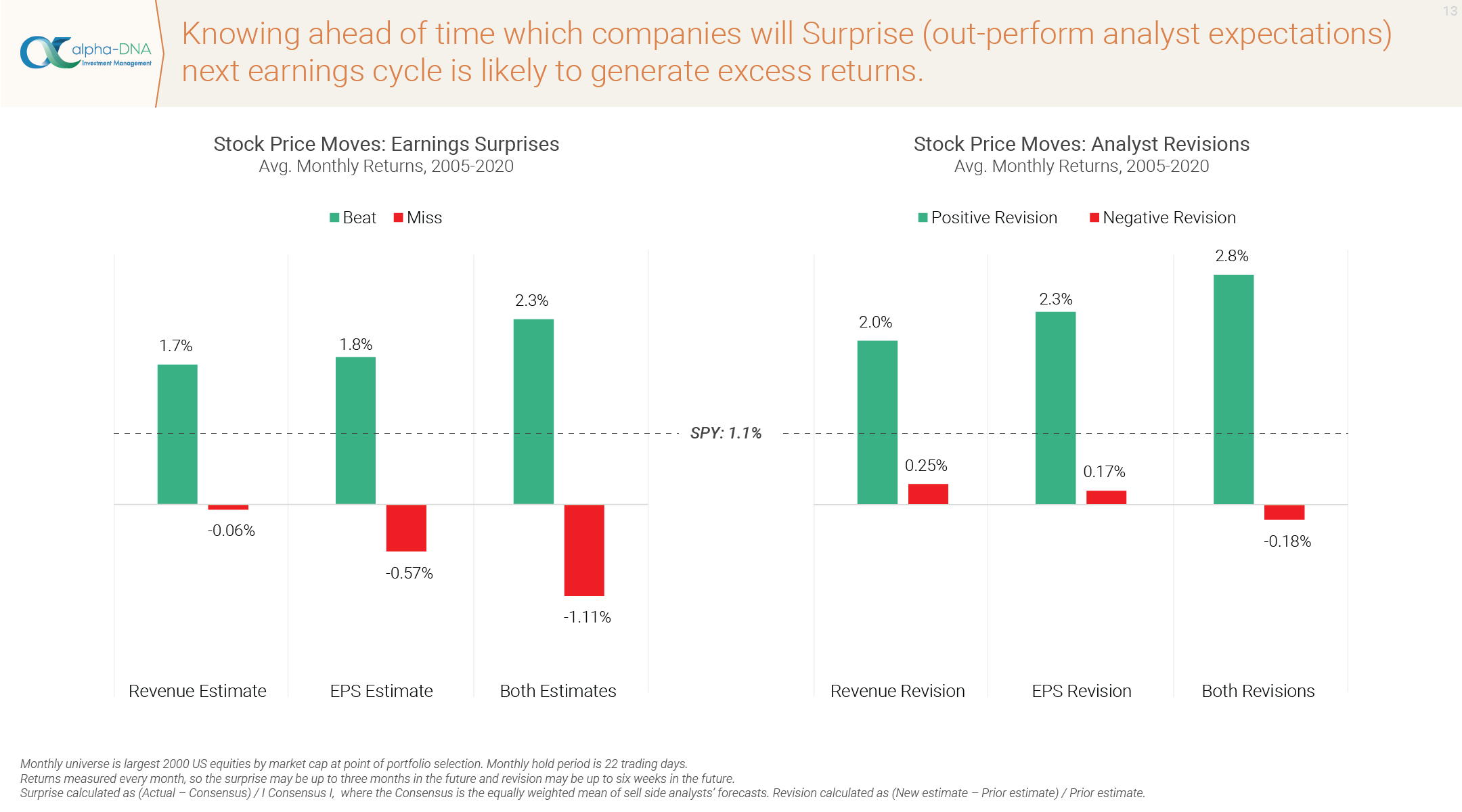

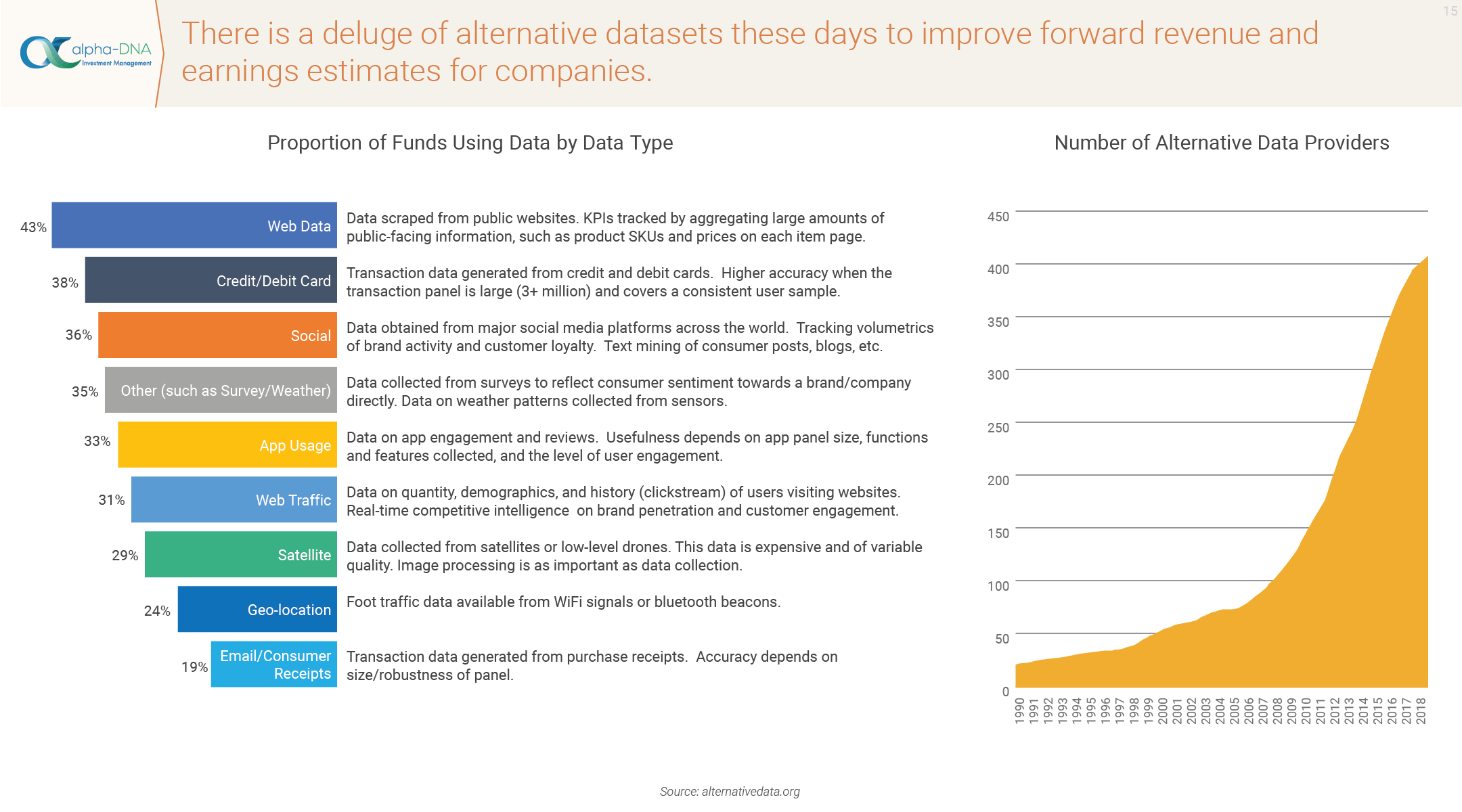

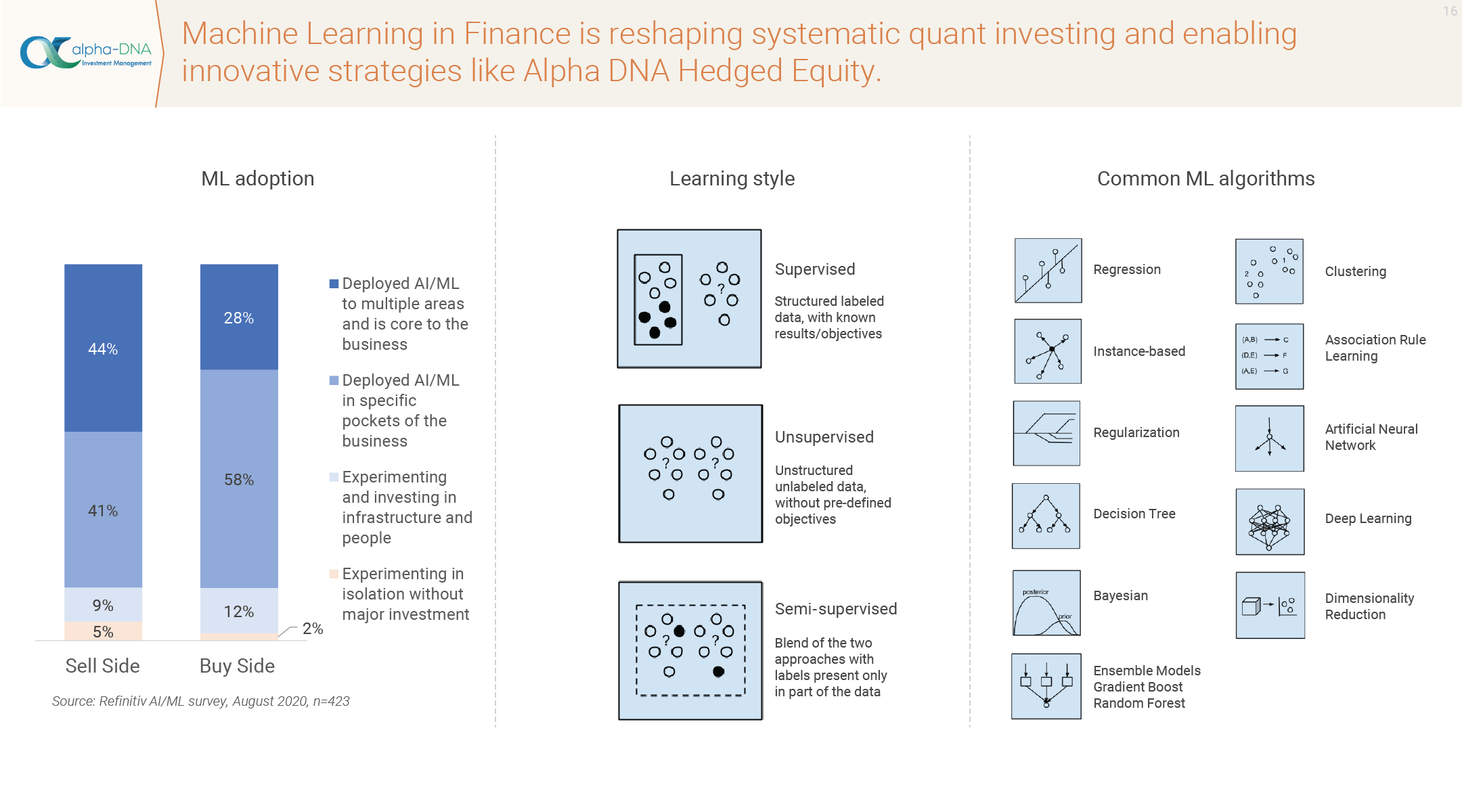

It is an objective fact that knowing ahead of time which companies are going to surprise (out-perform analyst expectations) next earnings cycle, or whose estimates are going to be revised upward in the meantime, will, on average, generate excess returns. But you don’t have a crystal ball to know these things ahead of time. You are only as good as your input data and forecasting engine.

See Alpha DNA’s surprise prediction accuracy. In the absence of a crystal ball, Alternative Data and Machine Learning help!

If you would like a copy of this presentation, click this link to download.